What is a Payment Gateway?

A payment gateway is software that acts as a medium between websites and banks. Through a payment gateway, users can transfer money to others in an instant, and that too without needing to leave their homes.

How does Payment Gateway Work?

The functioning of payment gateways is a little complicated as it involves various entities such as originators, acquiring banks, card schemes, and issuing banks.

Note: We have covered the functioning of the credit card payment gateway in this blog.

An originator is a customer or a person who starts the payment process on the website. Once this is done, the request for payment is sent to the payment gateway, which then collects all the necessary information such as transaction details, bank details, or any card details. It then stores the details in secured servers. After this, the payment gateway uses encryption to transfer these data to acquiring banks. After understanding the transaction requirements, acquiring banks send the relevant requests to card schemes. If the request is approved, then it is forwarded to the issuing bank, which informs the payment gateway that the transaction is successful. If the request is not approved by the card schemes, then the acquiring bank informs the payment gateway about the failure of the transaction. Either way, the payment gateway has to inform the originator about the outcome of the transaction.

Interesting right? Lets get into learning more about payment gateway architecture in this blog.

Different Types of Payment Gateways

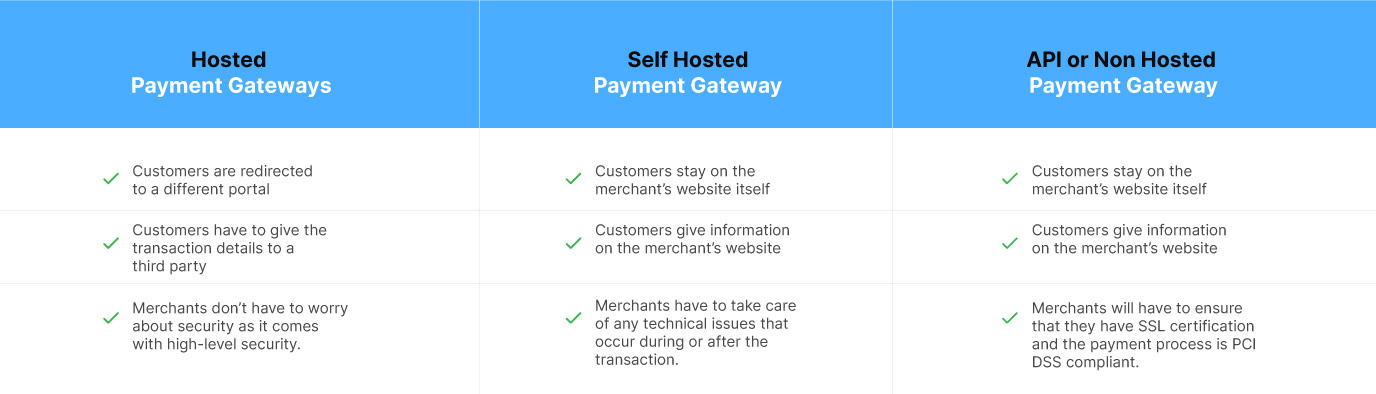

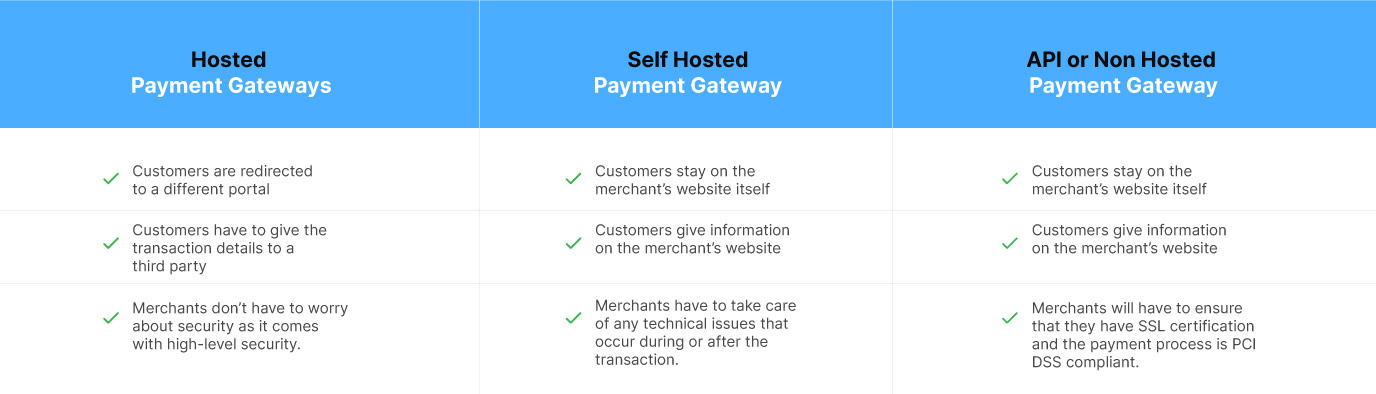

1. Hosted Payment Gateways

In a hosted payment gateway, customers are made to leave the merchant’s website and redirect to another secure gateway/website for payment. Here, customers have to fill out their payment details, and once the transaction is completed, they are redirected to the merchant’s website. These types of payment gateways work best for organizations that don’t want to go through the hassle of integrating and maintaining the website’s payment gateway. One of the key features of hosted payment gateways is that it comes with a high level of security, so the chances of fraud or any malicious activity are reduced to zero.

2. Self Hosted Payment Gateways

In a self-hosted payment gateway, customers are supposed to fill in the payment details on the merchant’s website itself. The details are then encrypted and sent to a third-party payment gateway, which performs all the activities and connects with banks, and then sends the signal to the merchant’s website stating if the transaction is successful or not. Self-hosted payment gateways are faster for checkouts as all the transaction is completed at one place, that is, at the merchant’s website. This puts the organization/merchant in nominal control of the payment activities. The downside of this type of payment gateway is that merchants have to take care of any technical issues that occur during or after the transaction.

3. API or Non-Hosted Payment Gateways

Application programming interference(API) or non-hosted payment gateways offer the merchant complete control over payment transactions. Customers have to fill in the payment details on the website, and the process will also happen on the same website via API. These kinds of payment gateways are fully customizable and can be integrated with websites as well as mobile applications. The most critical aspect of API or non-hosted payment gateways is that the merchant has to take care of the security, which mainly includes ensuring that they have SSL certification and the payment process is PCI DSS compliant.

Integrating Payment Gateway into a Website

One of the most important and complex tasks for any merchant is to set up payment gateways. One needs to be aware of the process and also be technically sound to integrate payment gateways with their website. Let us look at the steps of integrating Paypal (Hosted payment gateway) with a website –

- Signing up on Paypal

- Creating a Paypal Button

- Setting up basic payment

- Adding additional parameters to the basic payment

- Executing the payment once

- Validating the payment

- Authentication process

Keep in mind that all of these steps involve a lot of coding, which cannot be performed without a technical team. The same goes with API or non-hosted payment gateways, as to integrate any APIs with a platform, a lot of coding is required. So, if an organization doesn’t have a technical team, the question arises where to go?

Muvi Billing – a billing platform with PCI-DSS Level 1 certification where integrating any payment gateways is just a two-step process.

How to Integrate a Payment Gateway with Muvi Billing

It is important to note that the three steps mentioned below are for those who are new to Muvi Billing. If you are an existing customer, you can simply add a payment gateway by performing just step number 3, ‘add payment gateway.’

1. Sign up for Muvi billing

Signing up for any Muvi product is very easy as we don’t ask for any credit card details or bank account details. All you have to do is enter your email address, name, phone number, and the company that you work for. We also offer a 14-day free trial after signing up unless you decide to become our customer in-between.

2. Integrate Muvi Billing in 2 steps

Integrating Muvi Billing with any website is as easy as selecting which movie to watch. All you have to do is perform the following steps –

- To get the API Authorization Key, navigate to “Admin” –>” Advanced.”

- Under “Advanced Settings,” you will get the API Authorization Key and Muvi API Documentation link.

3. Add Payment Gateway

Before explaining the steps of adding a payment gateway, it is important to note that Muvi Billing does not charge for any transaction being done on your website. But, keep in mind that different payment gateways charge different amounts for each transaction. Please check the relevant payment gateway website to know more about it.

To add a payment gateway in Muvi Billing –

- Go to “Monetization” –> “Payment Gateways” in the admin section.

- Click on any of the available payment gateways to add to your website.

- Type the credentials in the corresponding field and click on “Submit”. The Payment Gateway will be added.

You can also add any other payment gateway not listed on the page. Click on “Add Payment Gateway” to add any hosted or non-hosted payment gateway.

Conclusion

It is important to understand the different types of payment gateways available and all the associated charges before opting them for your business. We are sure you have understood the functionality of a payment gateway and the types through this blog. It is now time to explore how easily you can add a payment gateway to your website. Explore Muvi Billing and try its 14-day free trial to experience the diverse range of features it offers, including high-level security, smart record-keeping, and 20+ payment gateways.

Add your comment