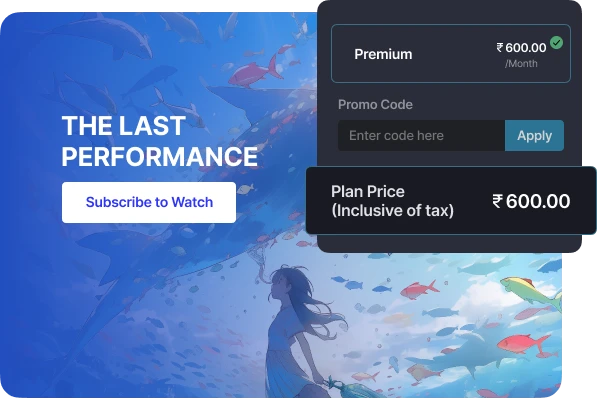

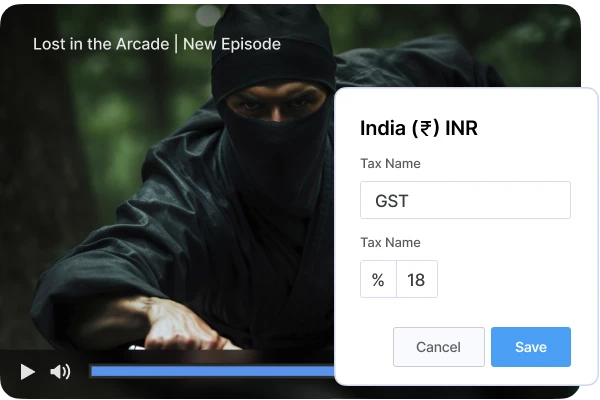

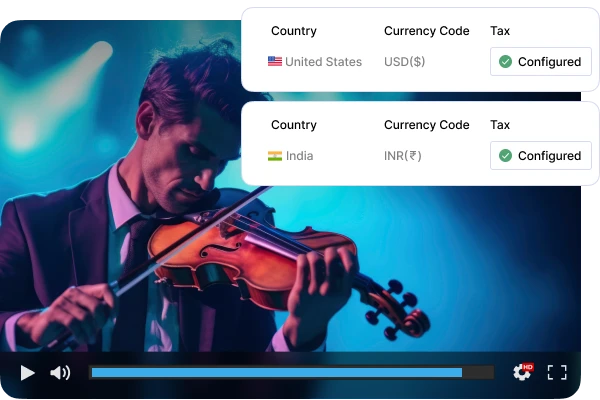

Taxation

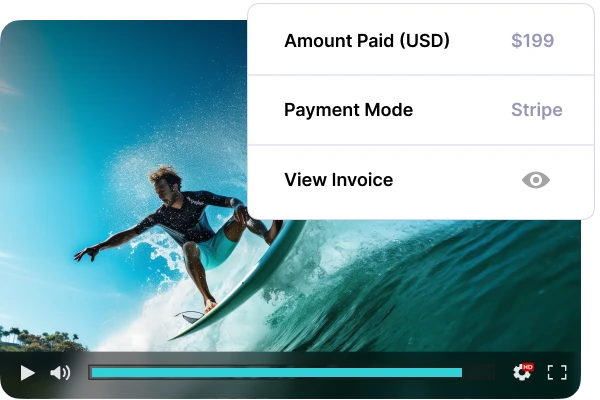

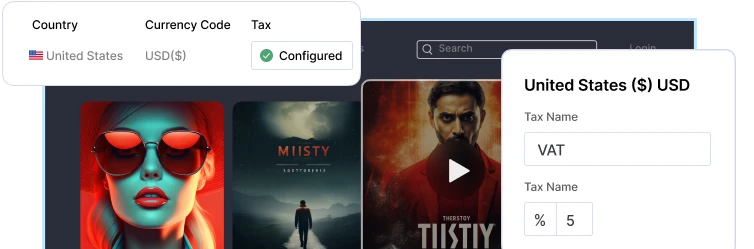

Configure taxes for your monetized content and enable transparent billing for customers.

Configure tax rules for your content for each country you deliver your content. Once configured, the tax amount is automatically calculated & applied to the final invoice depending on the user’s location.

- Instant Setup - No Coding or APIs Needed

- Country-Wise Inclusive Tax

- Location-Specific Tax Invoicing

Start your 14 day free trial today

- Instant Setup - No Coding or APIs Needed

- Country-Wise Inclusive Tax

- Location-Specific Tax Invoicing

Start Free Trial

Upgrade / Cancel Anytime. No Commitments.

Already using a platform?

Muvi will help with Data Migration, Customizations, and Integrations. Switch to Muvi today!

Migrate to MuviGet Your Free Trial Today. No Purchase Required

- Launch your very own Video/Audio Streaming Platform

- Get Websites and Apps across devices

- Stream Content across the Globe