Did you know that there were nearly 7.3 billion payments made in the United States in the 3rd quarter of 2021? All of these payments were made on the ACH network, and according to the NACHA (National Automated Clearing House Association), these payments were worth 18.1 trillion US dollars. Aren’t you curious to know more about a network that supports trillions of dollars transactions? Well, let us start with the basics first, such as ‘What is ACH,’ and then move on to ‘How does ACH work?

What is ACH?

ACH stands for Automated Clearing House Network, and it supports online transactions or payments from one bank to another. The process is fully automated, and there is no need for manual involvement. One of the most common uses of ACH that people fail to recognize is ‘salary deposits.’ There are different types of ACH networks, which we have described later in the blog; salary deposits come under the ‘Direct Deposit’ of ACH.

How Does ACH Work?

Before we dive deep into the details, let us first understand all the components associated with ACH functioning.

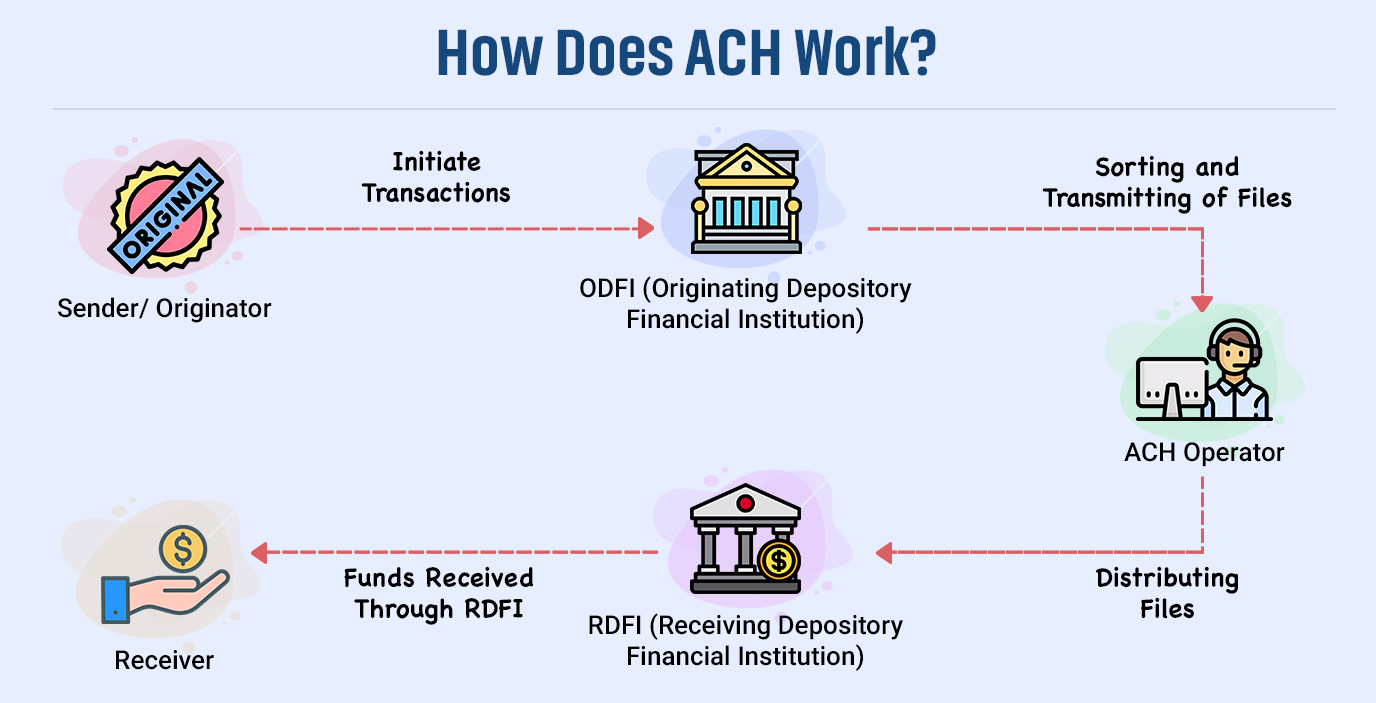

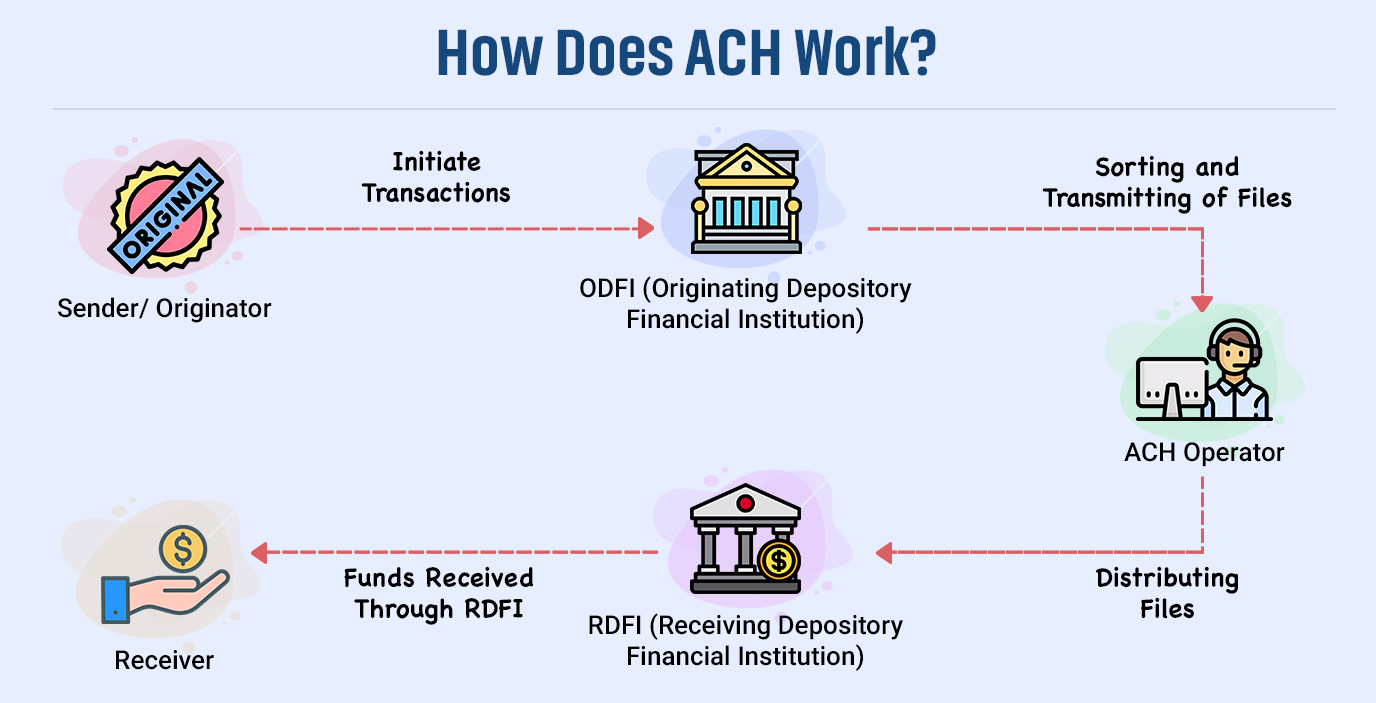

1. Sender/Originator

The person who is responsible for initiating the ACH transactions. This person can be a government agency, a corporate company, or an individual.

2. Originating Depository Financial Institution (ODFI)

ODFI is the financial institution approved by the National Automated Clearing House Association (NACHA), responsible for initiating/originating transactions once it receives payment instructions from the sender/originator.

Note – All transactions in ACH Network have to be made through a financial institution; otherwise, it won’t be considered an ACH transaction.

3. Receiving Depository Financial Institution (RDFI)

A financial institution approved by NACHA that is responsible for receiving payments during an ACH transaction so that it can be transferred to the receiver.

Note – An ODFI may have to act as an RDFI when a transaction fails, and a return process is initiated. However, in no circumstances, RDFI has to operate as an ODFI.

4. ACH Operator

ACH operator is the medium through which all ACH transactions take place. It receives transaction requests from ODFI and distributes them to suitable institutions. There are two types of ACH operators in the ACH network –

- The federal reserve bank

- Electronic payment network

However, the main ACH operator is the federal reserve bank, even though both the federal reserve bank and electronic payment network can be a part of the transaction.

5. Receiver

The person who receives the ACH transaction at the end, and also the person responsible for authorizing the sender/originator to initiate the transaction. Also, just like the sender/originator, the receiver can be a government agency, a corporate company, or an individual.

So basically, the sender/originator initiates the transaction and sends all the relevant information to ODFI. ODFI analyzes and sorts the information received, such as what kind of transaction it is and who initiated the transaction, and then it transmits the relevant information or files to the ACH Operator. Now, as mentioned above, ACH operators act as the medium through which all ACH transactions take place. So, once the files are received, it again analyzes them and stores the information for future reference. After this, the ACH operator distributes the information or ACH files to RDFI. Once RDFI receives these files, it makes funds available in the receiver’s bank account.

Different types of ACH Transfer

1. ACH Direct Deposit

The kind of transactions that are done from a business organization or a government entity to an individual’s bank account is known as ACH Direct Deposit. Some prominent examples of ACH direct deposit are – Salary, Tax refunds, and Government Benefits.

Also read : Understanding Payment Gateway

2. ACH Direct Payments

ACH direct payments can be made by anybody simply to send money, and it can be an individual, government entity, or business organization. Some of the examples of ACH direct payments are electricity bills paid online or recharging your wifi.

Add your comment