Written by: Roshan Dwivedi

In the beginning of January, the news of Netflix launching its operations in India has hogged on some serious limelight. This launch is part of a global announcement that saw Netflix being simultaneously launched in over 130 countries. However, its India launch got a lot of dynamics and pundits worked up.

Netflix : The Story Before The Launch

According to a media report, US-based Netflix has borrowed $1 billion to fund its international expansion. Netflix has around 69 million subscribers across 50 countries. Apart from its service, it has also become popular for producing original content like House of Cards, Daredevil and Orange is the New Black. In the US, subscribers pay $8.99 a month for watching HD-quality movies and TV shows on any two screens at the same time so the Indian prices are about on par.

Just recently, in its Q4 2015 reports, Netflix added 4 million subscribers globally despite missing out on its revenue projections. The miss is credited to an ongoing saturation in the US OTT video services market which again explains why Netflix is so interested in moving on to greener pastures.

Netflix : Impact On Content Monetization Models In India

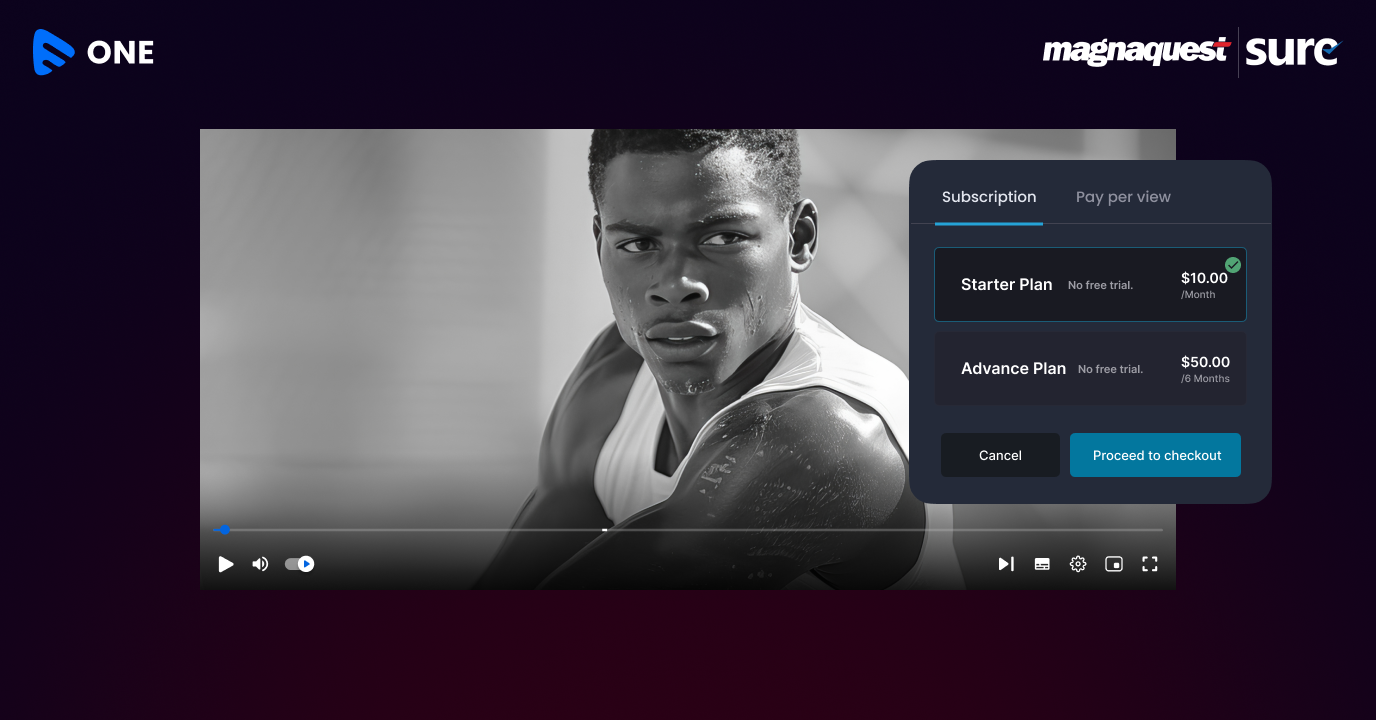

One of the reasons why Netflix’s entry and its subscription-based model are interesting because it raises the all important question – is the Indian consumer ready to shell out money for online video content?

Netflix’s entry is being welcomed by the Indian broadcasting industry, which is watching developments closely. This is a challenge to Netflix’s entry with most of the other players like Hotstar, SonyLiv and Spuul being driven by advertising revenue. Many believe that the Indian consumer is still not ready to cough up money to watch content. And this is where it will be interesting to see what impact the entry of Netflix has.

Subscription vs Advertisement: Netflix Can Effect A Change

Netflix’s subscription-based model might seem radical for the Indian market and with Netflix having announced that it is not looking to provide free content, they will have to figure out a business model that takes into account the unique Indian context. Of course, first month subscription is free but that is just to whip the appetite of the audience. Having said this, the industry is confident that SVOD is the way to go forward irrespective of the fact that it is far from maturity. Netflix’s arrival will open the door to more players in this category.

Such hybrid models are something which are even now being explored by OTT operators with varied success. Could the entry of a recognized player like Netflix help turn the tide?

Looking Ahead

Netflix has not yet missed a depth it has targeted and we can assume the same with its India launch. But what happens then? Where are the ‘other’ players? You can become the ‘other’ player, or say, the next Netflix with Muvi’s OTT video streaming solution.

Read more about how ISKCON teamed up with Muvi for its VOD service like Netflix and is now a cult phenomenon for religious & cultural streaming services.

Add your comment