Written by: Roshan Dwivedi

When we look at figures and forecasts, the fact that, this is the perfect time for OTT and digital video revenues to soar becomes clear. The trends are on all-time high, with over 2,563 on-demand services having established in the entire European Union.

Europe certainly is a growing OTT market. According to researches and studies, Western Europe OTT and online video market is expected to double in revenues between 2015 and 2021. UK certainly is going to be the biggest contributing market, amounting to 35% share of the entire Western European OTT market.

With an internet penetration of 79.3%, it is clear that the Western European audience is aware and is highly welcoming of new means of entertainment.

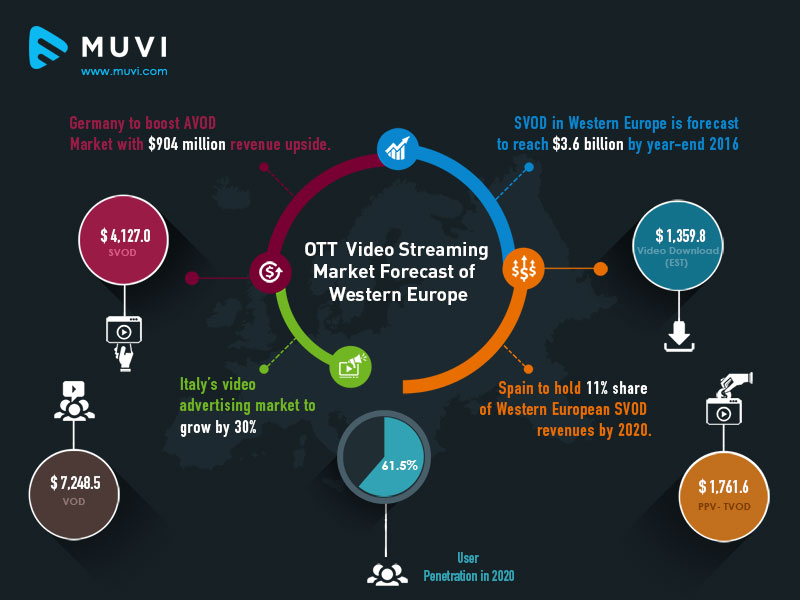

At the moment VOD penetration is at 12.69% and is expected to grow to 20.24% by 2020, and video on demand revenues in Europe are expected to show at huge growth from current USD 4,291.4 million in 2016 to USD 7,248.5 million in 2020.

Subscription (SVOD), being the most common type of VOD consumption in Western Europe, accounts to about half of the video on demand revenue share, standing at USD 2,582.8 million in 2016 and reaching USD 4,127.0 million in 2020. Pay-Per-View (PPV / TVOD), whereas, coming second, is expected to grow from USD 1,033.7 million in 2016 to USD 1,761.6 million in 2020. Not only this, Video Downloads (EST) still owns a small share of USD 674.9 million in revenues, which is expected to grow to make USD 1,359.8 million by 2020.

Looking at the country specific, a research from Digital TV Research states that OTT adoption in Scandinavia, Netherlands and the UK is quite high, but has been much muted in other countries such as France, Spain and Portugal.

Check our 360 Overview of OTT Video Streaming market landscape of Western Europe:

Let’s have a deeper look at the OTT market of growing Western European countries in specific:

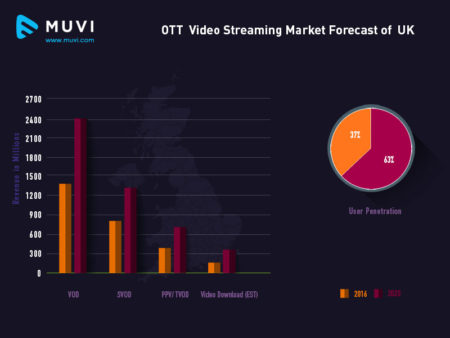

United Kingdom

With an internet penetration at a staggering 92%, OTT audience in UK is as aware and equipped with entertainment media as much you find in a US household. However, the major difference can be the availability of free services in the European region and thus, consumers are less likely to pay for a subscription. Still UK OTT user penetration shows a huge potential for growth from 31.83% in 2016 to 54.23% in 2020.

However, with an ARPU of USD 85.20, the total video on demand revenue is expected to grow from USD 1,446.1 million in 2016 to USD 2,427.6 million in 2020. Subscription services amount to USD 821.9 million, which is expected to grow at USD 1,330.3 million by 2020. Pay-Per-View and Video Download (EST) will reach from USD 414.8 and USD 209.4 million in revenue to USD 690.7 and USD 406.6 million respectively.

A Parks Associates study stated that 33% of UK broadband homes subscribed to an OTT service in Q3 2015, as compared those of 15% premium pay TV subscribers. A recent study by Zuora, Netflix is by far the biggest SVOD platform in the UK, with 12.4 million subs (which includes 24% of the adult population). Sky Go was the second most popular SVOD platform with 7.2 million subs, Amazon at third with 6.7 million and Now TV was with 3.1 million.

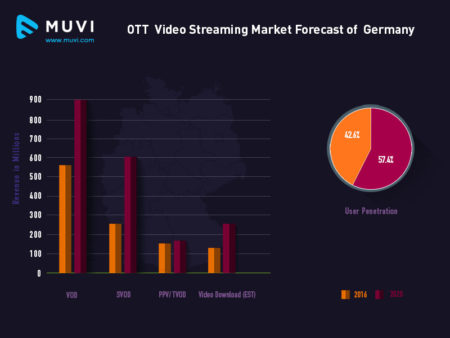

Germany

With the internet penetration of 88%, Germany is now showing great adoption for the recent video streaming boom. Music streaming is one popular activity among young millennials in Germany from the days of CDs to now streaming apps.

Video on demand in the country is still taking up and with the user penetration of 8.83% (which is expected to grow at 11.92% by 2020), VOD revenues are expected to grow from USD 560.3 million in 2016 to USD 900.0 million in 2020. It is evident that consumers love streaming as the SVOD revenues in the country were recorded at USD 273.2 in 2016 with an ARPU of USD 90.06. Pay per view accounted for USD 152.0 million in 2016 and is expected to reach USD 172.6 million by 2020, whereas Video Downloads (EST) is expected to grow from USD 135.1 million in 2016 to USD 254.7 million in 2020.

ZDFmediathek, Das Erste: Mediathek, YouTube (for TV programs) and Amazon Instant Video are the common video streaming platforms consumers in Germany prefer using. Whereas iTunes, Spotify and Amazon Prime Music are widely used for music streaming (source).

Forecast: OTT Video Streaming market landscape of Western Europe

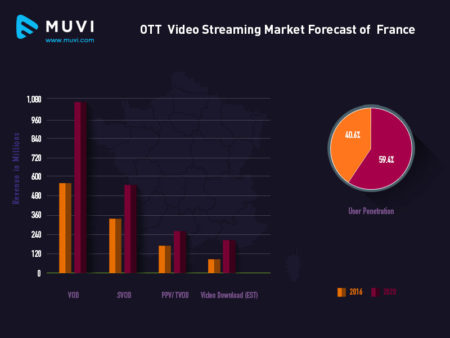

France

France enjoys a high internet penetration rate of 84%, which states that users are already using internet to access entertainment content. In fact, 94.2% of the 27.9 million TV households in France are digital. With over 219 VOD services and 126 catch-up TV services being available to the viewers, the penetration of video on demand services in the country is expected to reach 37.52% by 2020 from that of 25.65% recorded in 2016.

French OTT market is dominated by the demand for local content is this might probably be the reason for Netflix’s losses in the territory for 2 years after it launched and finally decided to shut the Paris office (source). Popular broadcasters in France as of 2015 are France Télévisions, Groupe TF1, RTL Group and Canal+. The SVOD market has majorly been dominated by CanalPlay and Netflix (after its launch in 2014) and now by Amazon.

VOD revenues are expected to almost double over next five years reaching USD 1,000 million by 2020 from that of USD 557.4 million in 2016.

Subscription services in France amount to USD 306.9 million in revenues in the current year and this is expected to reach USD 555.6 million by 2020, amounting to an ARPU of USD 39.64. Pay-Per-View and Video Downloads (EST) stand at USD 146.0 and USD 104.5 million in revenues and are expected to generate USD 244.9 and USD 199.5 million revenues by 2020 respectively.

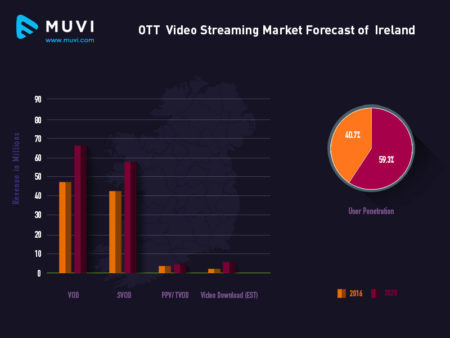

Ireland

With 3 in 4 Irish Adults (16 +) watching VOD content, the OTT market shows huge potential for growth in Ireland (source). With an internet penetration of 83% and ARPU of USD $150.90, Irish entertainment market is on huge surge. According to a July 2016 survey by IAB Ireland, 65% of respondents watched on-demand movies online in March 2016, while 45% watched sports live streaming.

Since, there is a huge trend and availability for free VOD platforms such as RTE, TV3 and Channel 4 as well as YouTube and other social channels in Ireland, the total Video on Demand revenues in 2016 were recorded at USD 48.3 million, which is expected to grow exponentially at USD 67.9 by 2020 as Netflix, Amazon and other subscription services brace their grips. The total penetration of VOD services in Ireland was recorded at 8.38%, which is expected to grow at 12.20% by 2020.

Subscription services amount to USD 42.1 million in revenues in 2016 and is expected to contribute USD 58.3 million revenues by 2020. While Pay-Per-View stood at the revenue of USD 3.4 million and is expected to grow at USD 3.9 million by 2020; Video Downloads (EST) to grow at USD 5.7 million in 2020 from USD 2.9 in 2016.

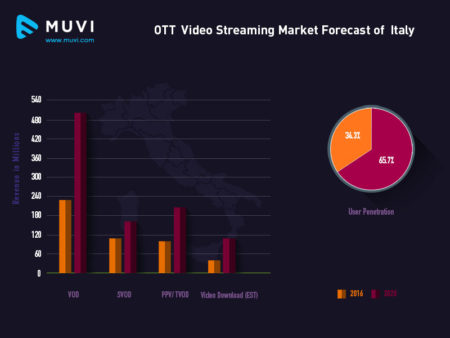

Italy

Italy watches more TV than any other country in Western Europe (more than four hours per-person per-day), according to a 2015 report. And with internet penetration of 62% and VOD penetration of 8.99% (which is expected to grow at 17.23% by 2020) Italy’s VOD market has shown a great VOD adoption rate over last few years.

The Video on Demand revenues in the country are expected to grow at USD 482.3 million in 2020 from that of USD 224.9 million in 2016. Italy’s subscription market is the fastest growing market, with over 17% people subscribing to SVOD services (source). Mediaset, Rai, Sky and Telecom Italia are the major broadcasters that rule OTT market in Italy.

The Italian SVOD market has generated USD 100.0million revenues in 2016 and is expected to grow at USD 166.3 million by 2020. The VOD penetration in the country is expected to show a great growth of 17.23% by 2020 from that of 8.99% in 2016, with an ARPU of USD 48.70.

Pay-Per-View, whereas, is also expected to show a substantial growth by 2020 amounting to USD 198.3 millions in revenues from that of USD 85.4 million in 2016. Video Downloads (EST) revenues is also expected to grow at USD 117.7 million by 2020 from that of USD 39.5 million in 2016.

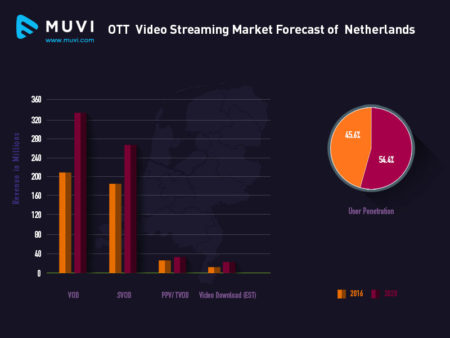

Netherlands

Netherlands has an Internet Penetration rate of 96% and according to a recent Dutch Consumer Video Behavior report, Dutch consumers devote 5% of their daily video usage to Video on Demand services, which accounts to about 15 minutes a day. When it comes to SVOD subscribers, the usage amounts to the viewing of at least 1 hour a day.

Some 17% of all Dutch households subscribe to Netflix, it being the most popular SVOD service in the country, especially among households with children (a quarter of these subscribing to Netflix).

About 2% of households in Netherlands don’t subscribe to pay TV and rely only on subscription services. Though the share is less but the Video on Demand revenues are showing a steady growth amounting to USD 214.3 million in 2016 and expecting to reach USD 329.3 million by 2020.

The VOD user penetration in the country is at 22.50% in 2016 at an ARPU of USD 67.79, and is expected to grow at 26.82% in revenues by 2020. Subscription services will generate revenues amounting to USD 270.5 million by 2020, growing from USD 182.1 million in 2016.

Pay-Per-View in Netherlands accounts to USD 21.4 million in revenues in 2016 and is expected to reach USD 38.2 million by 2020 and the Video Downloads (EST) amounting to USD 10.8 million in 2016 will reach USD 20.6 million by 2020.

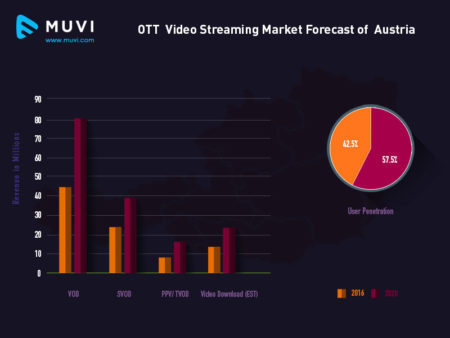

Austria

Xbox Video being the first ever international VOD service to be started in Austria back in 2009, today, foreign players such as Xbox, Sky, Germany’s Maxdome and Apple rule Austria’s video streaming market, all of these offering great selection of titles at a great selection of subscription options.

According to an IHS Screen Digest study in 2013, Austria’s online movie market was declared as having high potential for growth, recorded at $15.1 million in the same year (source). With an internet penetration of 83% and VOD ARPU of USD 45.46, the Video on Demand revenues accounted for USD 44.1 million in 2016 and is expected to reach USD 80.2 million by 2020.

Having a great selection of local as well as international subscription VOD services, the user penetration of video streaming services stands at 13.24% in 2016 and is expected to reach 17.88% by 2020.

Austria’s SVOD market enjoys a good revenue rate of USD 23.6 million in 2016, and is expected to grow at USD 39.7 million by 2020, according to statista reports. Pay-Per-View and Video Download (EST) amounting to USD 7.4 and USD 16.2 million in revenues in 2016, will reach USD 13.1 and USD 24.3 millions by 2020.

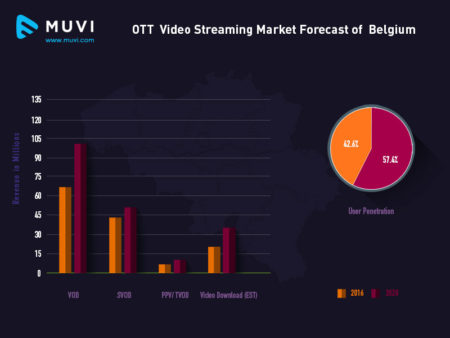

Belgium

A study published in 2015 by Belgian Entertainment Association (BEA) stated that for the first time in 2014, sales of VOD and subscription VOD services exceeded the sales of physical DVDs and Blu-rays. Electronic sales and rentals were €130 million in the year at an increase of 16% compared to last year.

During the year, DVD sales fell 21% to €95.7 million. Blu-rays never really caught on, during the past year sales dropped nearly 15% to €19.7 million. By volume, the Belgians bought 7.62 million of DVDs (down 24%) and 1.28 million of Blu-Ray (down 10.4%) (Source).

With an internet penetration of 85%, Belgian businesses are the second in Europe (50%) when it comes to e-information sharing through business management software. The VOD market is on all time high and expected to grow exponentially from USD 69million in 2016 to USD 99.4 million by 2020.

An IHS market study declared that by the end of 2016, Belgium and Netherlands combined will account for about 10% of total SVOD spending in the entire Western Europe. Revenues from subscription services in Belgium amount to USD 41.3 million in 2016 and are expected to reach USD 54.8 million by 2020.

The VOD user penetration is at 8.89% million in 2016 at an ARPU of USD 83.97 and is expected to reach 12.41% by 2020. Pay-Per-View accounts for USD 9.4 million revenues in 2016 and will reach USD 10.6 million by 2020. Video Downloads (EST) is expected to reach USD 34.0 million in 2020 from that of USD 18.2 million in 2016.

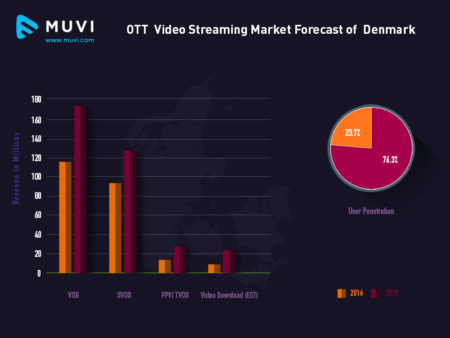

Denmark

With an internet penetration of 96% and an ARPU of USD 157.04, Denmark is one of the most progressive countries in Europe. According to the Digital Economy and Society Index, Denmark was ranked as the most digital country in Europe, boasting the most advanced use of digital public services.

In an entertainment market still dominated by Cable TV, IPTV is a rapidly growing in Denmark with over 17% of households (442 000) having subscribed to IPTV in 2014.

Video on Demand revenues in the country were recorded at USD 117.8 million in 2016, which is expected to reach USD 174.2 million by 2020.

With over 45 on-demand services being available in the country the subscription services contribute to USD 91.9 million in revenues, which is expected to reach USD 125.3 million by 2020. The VOD user penetration will take a huge leap from 15.97% in 2016 to 51.46% in 2020.

Pay-Per-View and Video Download (EST) will reach a massive growth of USD 26.4 and USD 22.4 million by 2020 from that of USD 16.3 and USD 9.6 million recorded in 2016.

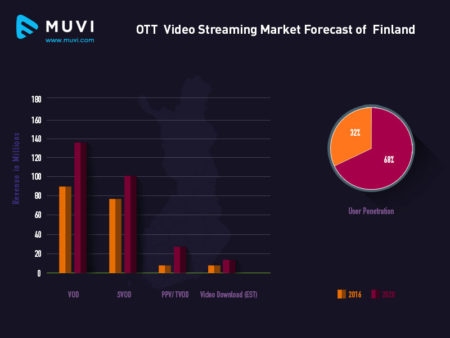

Finland

A recent survey on people’s video consumption habits in Finland revealed that over 88% of respondents between the age group of 35-44 years stated that they accessed video content via streaming or video-on-demand services at least once a week.

Finland’s Video on Demand is a healthy competition market with a mix of local as well as international providers succeeding at a good rate. Revenues from Video on Demand services in the country amounted to USD 90.5 million in 2016 and is expected to reach a good growth of USD 138.5 million by 2020.

With internet penetration of 94% and an ARPU of USD $160.59, Video streaming market in Finland is showing a great potential for growth. The overall user penetration for VOD services in the country is expected to grow from 12.36% in 2016 to 26.22% by 2020.

Video on demand subscription services market is expected grow from USD 76.7 in 2016 in the country to USD 101.1 by 2020. Pay-Per-View and Video Download (EST) will account for USD 24.1 and USD 13.4 million revenues by 2020 rising from USD 6.8 and USD 6.9 million in 2016 respectively.

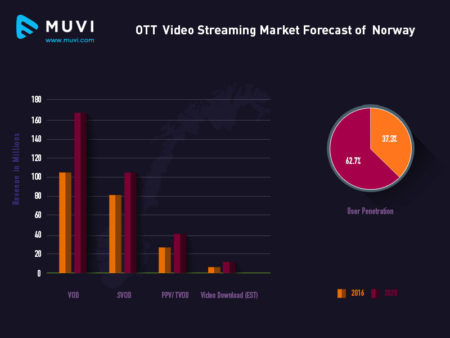

Norway

Norway has an Internet Penetration rate of 96%, and the highest SVOD penetration in the entire Nordic region, which clearly states that the country has huge potential for growth in the streaming world. With an ARPU of USD 105.64, the VOD user penetration is expected to grow from 25.50% in 2016 to 42.90% by 2020.

A recent NRK study stated that 24% people in the country now use OTT services as compared to that of 5% in 2012. YouTube is used by more than 40% and Netflix is used in 34% of Norwegian households. Music streaming has been recorded on all-time high in the country in 2016 Q1, accounting to 83% of revenues from recorded music (source).

Video streaming market is expected to grow at a good rate in revenues from USD 113.9 million in 2016 to USD 167.3 million by 2020. Subscription services to account for USD 114.7 million revenues by 2020, rising from USD 81.3 million in 2016.

Pay-Per-View and Video Downloads (EST) in Norway also show a great potential for growth, amounting to USD 26.6 and USD 6.0 million in 2016 to USD 40.6 and USD 12.0 million in 2020 respectively.

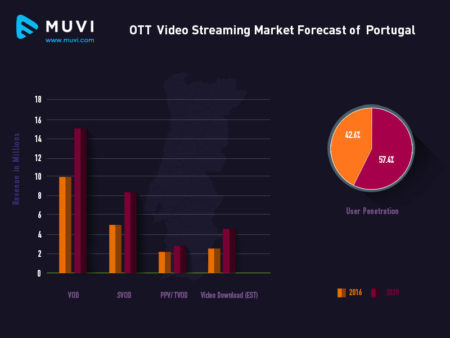

Portugal

Portugal had 43 available video on demand services by the end of 2015, out of which 9 are established in Portugal. The major players in the Portuguese VOD market include national versions of iTunes and Netflix, other than Portugal Telecom, Cabovisão and NOS.

Number of SVOD users who pay for subscribing OTT services in Portugal will reach 0.38 million by 2020 as compared to 0.08 million in 2016 (source). Video streaming services will generate USD 15.4 million revenues by 2020 as compared to USD 10.0 million in 2016.

SVOD revenues will reach USD 8.3 million in 2020 from that of USD 5.5 in 2016. With an internet penetration of 68% and ARPU of USD 19.80, Portugal is slowly but steadily gaining pace with the rising OTT market.

User penetration is expected to grow in the country from 5.58% in 2016 to 7.51% by 2020. Video Downloads will show a growth of USD 4.3 in 2020 from that of USD 2.3 in 2016 and Pay-per-view will grow to USD 2.8 by 2020 from USD 2.2 in 2016.

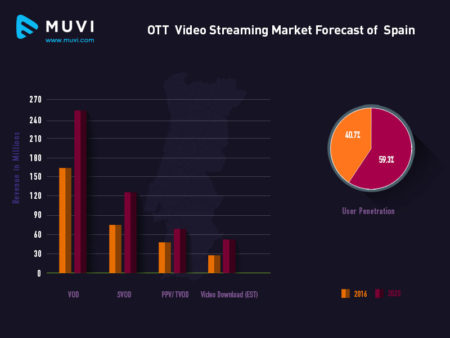

Spain

Spain has a high rate of web subscribers and broadband only homes who are more likely to opt out of Pay TV. This trend is even more popular among young millennials aged 24-35.

With an internet penetration rate of 77% and an ARPU of USD 40.64, OTT video streaming services will see a penetration of 15.02% by 2020 as compared to 10.29% in 2016.

Video on demand services will experience a massive growth in terms of revenues in Spain from USD 167.9 million in 2016 to reaching USD 251.8 million by 2020. With HBO’s recent launch in the country and Netflix’s success from its launch in last year, Spain has huge potential for subscription services and will grow in revenues from USD 85.2 million in 2016 to USD 131.6 million by 2020.

Video Downloads (EST) will grow at a good rate from USD 28.9 million in 2016 to USD 54.3 million in 2020 with Pay-Per-View which will grow to contribute USD 65.8 million revenues in 2020 from that of USD 53.8 in 2016.

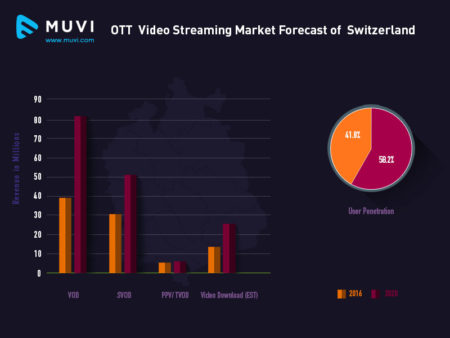

Switzerland

With internet penetration of 87%, OTT video market in Switzerland is well established as you can expect from a market with advanced broadband infrastructure. With over 53 on demand services and 37 dedicated video on demand services, Switzerland’s video on demand market has huge potential for growth.

Overall the country has access to 64 VOD services and 147 on-demand audiovisual services including local as well as international players.

The video streaming market in the country is expected to grow from USD 49.4 million in revenues in 2016 to USD 82.7 million by 2020. With user penetration of 9.33% in 2016, which is expected to grow at 13.01% and an ARPU of USD 74.97, video streaming is sure to take up.

Subscription services to generate revenues of USD 51.8 million by 2020 from that of USD 30.2 recorded in 2016. Video Downloads (EST), in fact, is expected to grow from USD 13.9 million in revenues in 2016 to USD 25.5 million by 2020.

Download our Info-graphic – OTT Video Streaming Market Forecast for Western Europe

Conclusion

With more and more subscription services reaching different parts of Western Europe, the region is showing more than a welcoming sign to the OTT adoption. With Netflix’s success in almost all the regions it has launched, Amazon and other providers are taking the same route to success.

Consumers are opening up to spending on subscription services and this is sure sign of a better rise in terms of adoption as well as revenues contributing to the success of entire Western Europe region. Europe may also be considered a rigid territory where global providers may need to go highly local in order to set a strong impact. Given high internet penetration in most parts of Western Europe, the region is sure on a right lane to OTT success.

Muvi helps video content owners to quickly launch their own white labelled video streaming platform across screens and devices such as Web, Mobile, Smart TV platforms, Media boxes and Consoles, within a matter of few clicks!

Sign Up for a 14 Days FREE Trial with Muvi and unlock your ticket to the world of streaming..

Add your comment