Written by: Soumya Sekhar

The Over-the-Top (OTT) business in Asia Pacific was unorganized with the presence of geographically focused players such as Hooq, Spuul, BoxTv, etc. It began full-fledged in 2015 with the arrival of Netflix in Japan and Australia, which slowly landed in other APAC countries the following year. Today the region is host to a number of streaming services, including various local players, such as Hong Kong-based Viu, Korea-based Pooq, Beijing-based iQiyi, etc.

The region’s telecom landscape has been a big driver of its OTT market and some of the telcos have been providing OTT services themselves. The APAC population has high adoption rates of fixed broadband, mobile broadband, and pay-TV. Singapore and South Korea, record pay-TV and smartphone penetration at as high as 80%.

In the Video on Demand (VOD) category, some of the prominent players in the APAC region include Netflix, Youku Tudou, iQiyi, Viu, Tencent Video, LeTV, Hooq, Amazon Prime Video, iFlix, YuppTV, Hotstar, NexGTV, Spuul, Eros Now, BoxTV, Catchplay, Hulu, dTV, Pooq, Tving, Watcha Play, etc.

Facts and Forecast

OTT is currently appealing to the modern digital consumer and is set for global domination, with particularly Asia getting quite competitive. Netflix and iQiyi are two promising service providers who have been pushing traditional pay-TV operators out of the top five rankings the region.

According to a report from Ovum, two Asia-Pacific countries – Japan and Australia currently have 16.5% and 21.7% share of the world’s OTT revenue, respectively. The Asia Pacific region is quite promising with around 1.8 billion unique subscribers and 3.8 billion connections.

Researchers have estimated the OTT services market in Asia Pacific to experience a quick upsurge by the end of next year. These numbers are quite encouraging. It is expected that APAC OTT video revenue will be worth $24 billion by 2021. Local pay-TV operators are also rolling out their branded OTT services to compete with the mainstream OTT players.

In terms of growth, APAC is projected to add 600 million new subscribers, and 1.6 billion new smartphone connections by 2020.

In 2015, video accounted for 55% of total mobile data traffic and the share is likely to grow to 75% by 2020.

Only 3 years ago a meager 0.2% APAC households subscribed to an SVOD package, and it is estimated to grow multifold to 7.7% (amounting to 68.83 million) by 2020, to contribute a total revenue of $11.29 billion.

China alone will have 139 million SVOD subscribers accounting for 59% of the region’s total, thus contributing half of the revenues for the 22 OTT countries, by 2022. China and Japan together will account for 66% of the region’s total revenues. By 2021, Indian VOD subscribers will reach 14.6 million, and will be followed by Indonesia at 9.96 million and Japan at 8.1 million. India and Japan will together account for 50 million subscribers.

Here is how the current OTT scenario looks in major APAC countries, and how it’s likely to grow.

Data Courtesy: Digital TV Research

OTT market in Australia will be dominated by Netflix. The Indonesian market will grow from $7 million to $40 million, and Thailand will grow from $8 million to $45 million. Moreover, Thailand and Indonesia will see their local service providers having captured a major portion of the market.

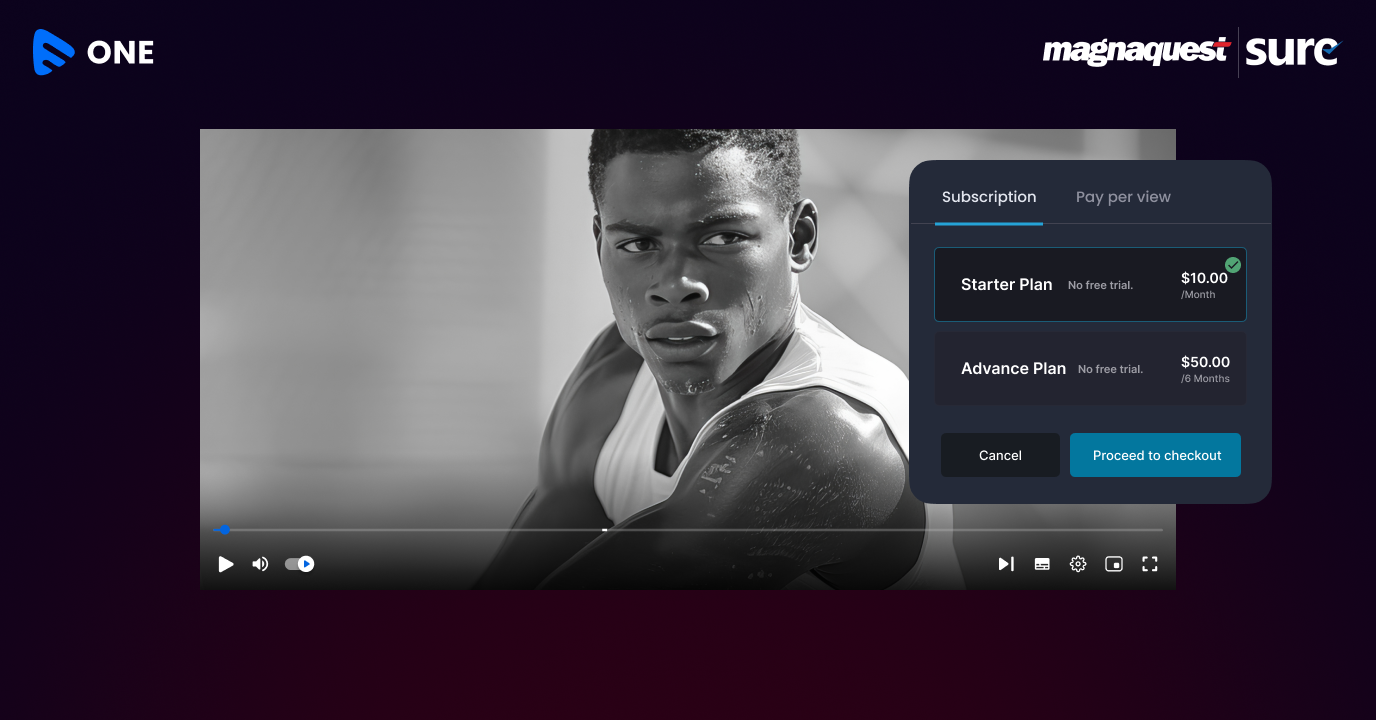

Platform owners now have creative ways to sell videos online and optimize their cash flow. At the same time, they are also coming up with flexible solutions to accommodate a range of plans and payment preferences.

[ Muvi offers a range of options to monetize your videos online. Check out features, and more. ]

Telcos driving the OTT game

To compete in the Asian market, online streaming services are tying up with telecom companies to expand their customer reach and deliver content seamlessly. Service providers are thriving to stabilize their revenue and attain customer loyalty. Revenue and profits are on one side, but what streaming services are aiming at is penetration, reach, and customer acquisition. Many SVOD providers are now turning towards telecom companies to achieve this objective and enhance their services. In the emerging APAC market, mobile networks provide a way to expand the targetable OTT market while W-Fi represents a key enabler technology.

Telecom operators, ISP providers and cable TV distributors in APAC foraying into the OTT delivery space include names such as PCCW, Bharti Airtel, Idea Cellular, Reliance Jio, Vodafone India, Telkom Indonesia, Indovision, PT First Media, XL Axiata, NTT DoCoMo, Jupiter Telecom, Sky Perfect TV, SoftBank, KDDI, Korea Telecom, SK Telecom, LG U+, Astro, Telkom Malaysia, Smart Communications, Globe Telecom, TrueVision, Chunghwa Telecom, Far EasTone, etc.

Bottlenecks in APAC OTT growth

The main hindrance to the growth of OTT market is the worrisome broadband infrastructure in some territories and limited access to affordable fixed line services.

Also, local language programming is quite crucial to the acceptance of streaming services in the region, especially Thailand and Indonesia. Local pay-TV providers are being preferred over OTT services majorly because of this reason; which needs to be beaten soon.

The expansion of OTT market, in general, will be driven by Netflix because of its one-size-fits-all offerings. Consumers will opt for similar services and rule out others. That’s an entry barrier that many players will have to overcome.

As the Asia Pacific region is getting digitized rapidly, people expect to access quality content delivered online. APAC is a hub that has not been fully exploited by OTT players. The future for OTT players in the region is quite promising and is expected to upsurge. A good mix of original content, viewing experience, and delivery plans and packages can turn the table for any upcoming player.

[ Sign Up with Muvi, and reap the benefits of seamless content delivery across the world instantly. ]

Add your comment