Written by: Roshan Dwivedi

Cable TV has been the most preferred way to get quality television content for decades now. However, there has been a shift from traditional viewership towards streaming services. Viewers have realized that despite its tasteful content, cable TV subscription is turning out to be heavy on their wallets.

With the rise of streaming services, one no longer needs to pay through the nose to access quality content; hence the rise of cord cutters.

In case you are wondering what “cutting the cord” means, let me elaborate.

What is Cord Cutting?

Consumers who unsubscribe from cable/linear TV and move towards internet streaming services are called cord cutters. There also are individuals who have never subscribed to any traditional pay TV service. They are called cord nevers.

Cord cutting has been growing rapidly as streaming services such as Netflix, Hulu, and Amazon Prime have replaced the traditional means of watching TV. So one no longer needs to buy a TV in order to watch it. This has enticed millennial viewers.

How they behave!

Cord cutters primarily aim at limiting their expenses, but they also prefer to stream mostly on mobile devices. Cord Nevers also aim similar, but TV somehow fails to earn a share of their wallet.

Let’s have a look at the facts and figures about cord cutters, cord nevers, and subscription services across geographies.

How big they are!

According to a recent study by MoffetNathanson, pay TV lost 762,000 subscribers in the first quarter of 2017 in the U.S. In 2015, 1.1 million people cut the cord, which rose to 1.7 million in 2016. That’s close to 55% growth in the number of cord cutters. Going by this trend, the numbers for 2017 can be quite promising.

In the US, the average age for cord nevers is 34 years and they represent 9% of all US consumers. More than half the cord nevers are millennials. YouTube is the most preferred streaming services followed by Netflix and Amazon. Cord nevers like short-form video content whereas cord cutters go for services such as PBS Video, Disney Movies, and A&E.

Global Subscription services

There are more than 2,563 on-demand services established in the entire EU. Studies reveal that revenues in Western Europe for OTT and online video market are expected to double between 2015 and 2021. UK’s share is 35% of Western European OTT market.

VOD penetration is at 12.69% in Europe and is expected to grow to 20.24% by 2020. Video-on-demand revenues in Europe are estimated to grow from US$ 4,291.4 million in 2016 to US$ 7,248.5 million in 2020.

Subscription video on demand (SVOD) is the most common type of VOD consumption in Western Europe which accounted for half of VOD revenue and amounted to US$ 2582.8 million in 2016. This number is expected to reach US$ 4,127 million in 2020.

OTT adoption in Scandinavia, Netherlands and UK are quite high but relatively low in other countries like France, Spain and Portugal as per a research from Digital TV Research.

The global OTT services market was valued at US$ 925.87 bn in 2016 and is expected to grow at a CAGR of 16.4%(2017-2015) and reach US$ 3,583.04 bn in 2025.

North America topped the OTT services market in 2016 and is expected to maintain a robust growth throughout the forecast period 2017 to 2025.

A major factor influencing the growth of OTT services market in North America is better mobile internet penetration as compared to other regions. The average internet speeds in U.S.A and Canada are in the range of 13.1 to 14 Mbps.

[ Launch your own subscription based streaming service instantly with Muvi’s SaaS based platform!]

Now let’s look at some figures on how streaming services such as Netflix have grown over the years.

Netflix’s annual revenue has grown a staggering 10 times between 2015 and 2016. In the first quarter of 2017, it crossed the 100 million mark in terms of number of streaming subscribers; with more than 50% subscribers coming from the United States alone. About 37% of consumers in the U.S streamed content from Netflix on a weekly basis.

Mexico, Canada and Brazil are some of the most important markets for Netflix with it’s penetration in these markets standing at 50% in the second quarter of 2016.

Amazon Prime and Hulu Plus are the main competitors of Netflix in the SVOD service market in the U.S. Netflix revenues are expected to cross the 7 billion U.S dollar mark by 2020.

Global facts on Subscription services:

- According to GFK MRI Cord Evolution data, Netflix is the number 1 streaming video service among Cord Cutters, with 57% saying they have used the service in the past year; in addition, 50% said they had used YouTube and 37% used Amazon.

- Among Cord Nevers, YouTube beats out Netflix (46% versus 39%), with Amazon again coming in third, at a much lower 25%.

- As per a report in NewsWeek, Dish Network lost more customers than other networks between April and June 2017; as almost 1 million subscribers dumped their TV bundle for digital options like YouTube Red, Netflix and other streaming services.

Comcast, Charter Communications, and AT&T’s DirectTV also saw declines in subscribers in 2017. - With the declining customer rate of 2.7%, cable and satellite companies are experiencing fastest rate of subscriber loss ever.

Only few Television channels such as HBO have managed to survive this rise in cord cutters by offering popular prestige series like Game of Thrones. Otherwise, it has overall been a struggle for cable providers to keep up with the pace of the changing trends unless they sell videos online. Now that we have looked at Netflix’s growth as an SVOD provider, it’s interesting to note how it is also heavily investing in content.

Typically OTT platform owners buy content from content owners or content distributors.

As per BTIG Research analyst Richard Greenfield, Netflix, the biggest SVOD company, listed its 2017 budget for content at $6 billion. This has set a benchmark that other SVOD companies would attempt to match.

How technology is automating streaming services!

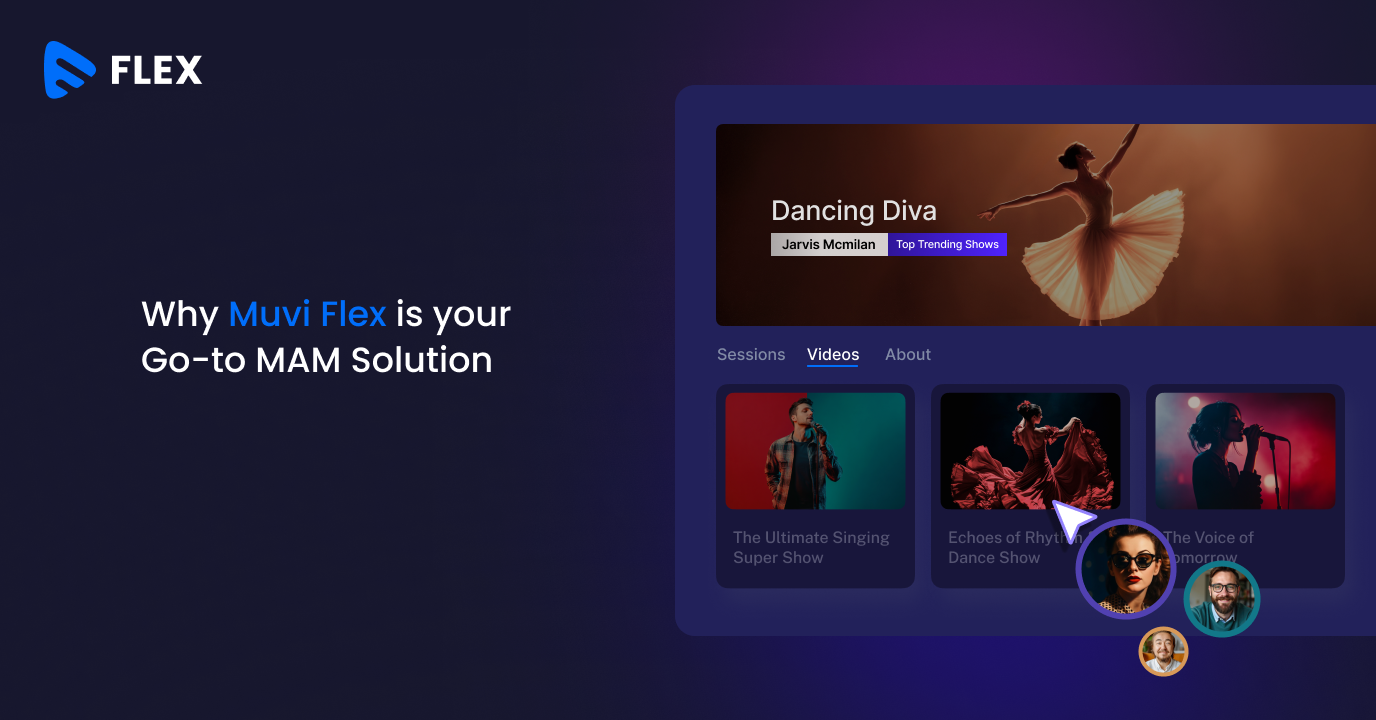

Technological advancements with OTT platforms such as Muvi facilitates instant launch of SaaS based content distribution channel. Content owners need not break their heads over distributing and monetizing their course.

Let’s say a popular yoga instructor wants to monetize her/his classes online. They can sign up and build a very intuitive platform on Muvi to host them on video streaming server, configure a subscription model within no time, and earn from the viewers by live streaming.

Add your comment